Offshore staff

LONDON –Well intervention has become a critical feature of the future profitability of brownfield assets as operators seek to extend economic production for as long as possible, observes Infield Systems, and this is driving growth. The global intervention and workover market is set to increase from an estimated $9.97 billion to $17.48 billion in 2018.

In discussing the topic, Infield Systems’ Senior Advisor for Strategy Bent Mathisen said that the aging subsea infrastructure in the North Sea will require more intervention to carry out light works such as removing sand, scale, or wax precipitates as well as heavy duties such as re-drilling of side tracks and christmas tree change-out.

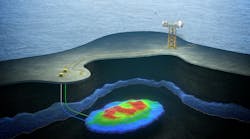

Another driver of the general growth isdeepwater work, Mathisen said. As operators push into deeper environments, and/or look toward satellite wells and tiebacks there is a natural need for well intervention services.

The vessel demand for subsea well intervention is certainly a critical issue for the North Sea industry, he continued. Currently there is a mix of drilling units, LWI specific vessels and other DP vessels in use – however the increasing deepwater trend and the need for lower cost options has developed some interesting patterns. Reduced rig demand resulting from the oil price decline has made them more price competitive with lighter service vessels while retaining an edge on capacity.

02/26/2015